tax strategies for high income earners australia

What Is A High Income Family In Australia. According to an analysis of countries around the world by.

If You Re A Younger Worker In Australia Don T Be Fooled On Tax Cuts Greg Jericho The Guardian

Superannuation contribution options to reduce taxes.

. You make your contributions with pre-tax dollars as the money is deducted from your payroll. Thats why its one of the most popular tax reduction strategies. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

A donor-advised fund DAF is an investment account created to support. Individuals are entitled to claim deductions for expenses directly related to earning taxable income. Additionally tax-deferred accounts benefit by.

With the budget announcement of a temporary 2 budget repair levy for taxable incomes above 180000 those who will be affected may wish to. Implementing the Tax minimization strategies is the prime lookout for every high-income earner in Hobart. In Australia the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates.

Ad Smart Investing Can Reduce the Impact of Taxes On Investments. Given that most are employed in. Ad Browse Discover Thousands of Law Book Titles for Less.

Using a donor-advised fund DAF is probably one of the best tax strategies for high income earners. However tax-deferred accounts can be an effective tax strategy for high-income earners to reduce current year tax liabilities. A range of both basic and advanced tax strategies and investment options can be explored to this end.

Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super. Tax deductions are expenses that can be deducted from your. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

If you are among them then you shall definitely need guidance and. If you are a high-income earner it is sensible to implement tax minimisation strategies. If you have 100000 of assessable income for the year your tax payable would be approximately 26000.

Contact a Fidelity Advisor. How to Reduce Taxable Income. A tax offset of 10000 would reduce your tax payable down to.

Tax Planning Strategies for High-income Earners. Specifically contribute to a traditional 401 or IRA. Max Out Your Retirement Account.

Because it allows you to take current and future year contributions. Reduce the income tax paid on dividends through franking. August 12 2014.

In australia the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates. To claim a work- related. Taking advantage of all of your allowable tax deductions and credits.

Take advantage of the lower rates under the Tax Cuts and Jobs Act before they sunset in 2025. Appropriate types and amounts of insurance cover. Effective tax planning with a qualified accountanttax specialist can help you to do.

Based on the Australian Taxation Office 62000 taxpayers in the top 1 percent earned an average taxable income of 760853. Pay taxes now at what may ultimately be lower marginal rates than you would be subject to in. Change the Character of Your Income One way to reduce your tax burden is to change the character of your income.

Tax Saving Strategies for High-Income Earners. 6 Tax Strategies for High Net Worth Individuals 1.

Is Australia S Tax System For High Income Earners Harsh Or About Right R Ausfinance

Tax Minimisation Strategies For High Income Earners

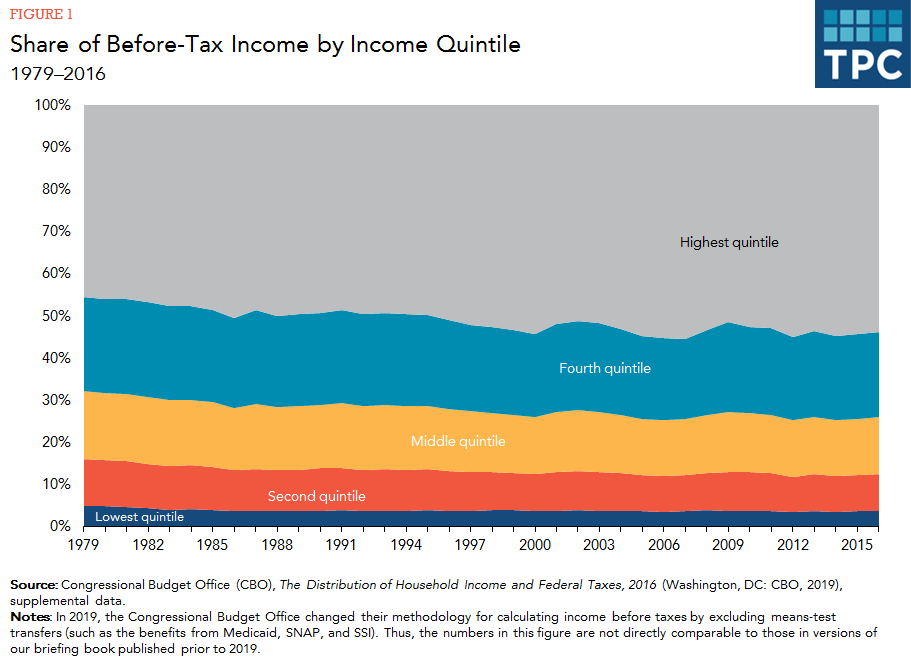

How Do Taxes Affect Income Inequality Tax Policy Center

Risk Based Pricing Strategies For A New Reality In Banking Thoughtworks

Worried About Taxes Going Up 9 Ways To Reduce Tax

How To Pay Less Taxes For High Income Earners Wealth Safe

Six Ways To Pay Less Tax Aviva

Tax Efficient Retirement Withdrawal Strategies

Taking Dividends Vs Salary What S Better Starling Bank

How Do High Income Earners Reduce Taxes In Australia

/GettyImages-469191068-ac2deb35657a41e58de5bd3a2ff27c62.jpg)

Top 6 Strategies To Protect Your Income From Taxes

How To Pay Less Taxes For High Income Earners Wealth Safe

5 Strategies To Reduce Investment Taxes

Annual Report Hsbc Holdings Plc

Three Steps For Tax Savvy Portfolio Withdrawals J P Morgan Private Bank

Closing The Gap In Us Retirement Savings Deloitte Insights

How To Pay Less Tax As A Contractor Or Ltd Company Contractor Tax Efficient Salary

Some Of Australia S Highest Earners Pay No Tax And It Costs Them A Fortune Greg Jericho The Guardian

Some Of Australia S Highest Earners Pay No Tax And It Costs Them A Fortune Greg Jericho The Guardian